MORTGAGE EDUCATION

Why an FHA Streamline Refinance Could Be a Smart Move Right Now

For homeowners with an existing FHA loan, the FHA Streamline Refinance offered through the Federal Housing Administration can be one of the simplest w …

Read More

Why a 15-Year Mortgage Might Be the Smartest Move You Can Make

When most buyers think about financing a home, the 30-year mortgage gets all the attention. It’s familiar, flexible, and keeps monthly payments lower. …

Read More

Why Mortgage Insurance Is Actually a Win for Homebuyers

When buyers hear the term mortgage insurance, the first reaction is often negative. It’s easy to assume it’s just another fee added to the monthly pay …

Read More

Leveraging Equity: How Smart Investors Use Existing Properties to Grow Their Portfolio

In today’s real estate market, savvy investors are finding that the key to accelerated growth isn’t always buying new properties using cash assets, it …

Read More

Qualifying for a Mortgage as a Gig Economy Worker

The workforce is changing. More Americans than ever are earning income through the gig economy driving for rideshare companies, freelancing online, ru …

Read More

How the $200 Billion Mortgage Bond Purchase Could Reshape Mortgage Markets, Homebuyers and the Economy

On January 8, 2026, President Donald Trump announced a bold initiative directing the federal government to have Fannie Mae and Freddie Mac purchase $2 …

Read More

Higher Conforming Loan Limits for 2026

The Federal Housing Finance Agency (FHFA) recently announced that the baseline conforming-loan limit for 2026 will rise to $ 832,750 for a one-unit ho …

Read More

Home Purchase Guide: How to Buy a Home with Confidence

Buying a home is one of the biggest financial decisions you’ll ever make—but it doesn’t have to be overwhelming. Whether you’re a first-time homebuyer …

Read More

Benefits of working with a Mortgage Loan Officer

Expert Guidance Navigating the Process: A mortgage loan officer helps you understand the complex mortgage application process. Loan Options: They prov …

Read More

FHA vs. Conventional Loans

Compare two of the most popular loan options to find the right fit for your goals. FHA and Conventional loans are two of the most popular ways to buy …

Read More

Real Estate Investing is a Smart Long-Term Investment

Investing in real estate has long been regarded as one of the most reliable ways to build wealth. From owning a single rental property to participatin …

Read More

DTI!

If you are in the home buying process, you have undoubtedly heard the term DTI over and over again. What is a DTI and why is does it matter? DTI stand …

Read More

Mortgage Glossary

2/1 Buy Down MortgageThe 2/1 Buy Down Mortgage allows the borrower to qualify at below market rates so they can borrow more. The initial starting inte …

Read More

10 DO NOTS

10 DO NOTS:When Applying for a Mortgage Getting a Mortgage Loan is all about your ability to repay that loan. Even if you have a preapproval offer fr …

Read More

Loan Application Steps

How much can you borrow – Get Pre-Qualified The first step in obtaining a loan is to determine how much money you can borrow. In case of buying …

Read More

Pre-Approval Process

Get Pre-Approved! Are you shopping for your new home? Many lenders offer a quick Pre-Qualification, basically a review of your credit report and …

Read More

Home Purchase Basics

Congratulations on your decision to buy a new home! There are many important things to consider throughout the process, especially if you’re a first-t …

Read More

Power of Home Ownership

Here at Fidelity Direct Mortgage, we believe that owning a home is more than just a financial investment; it is a symbol of independence and security. …

Read More

Locking Your Mortgage Rate

One of the most pressing issues when applying for a mortgage is when do I lock in my mortgage rate? Rates go up. Then rates go down. When is the right …

Read More

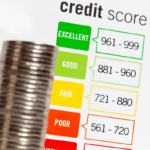

Secrets of a Credit Score!

Your Credit Score helps financial institutions determine your overall credit situation. A Credit Score helps insurance companies, and employers determ …

Read More

HOME EQUITY

What is Home Equity? In an economic climate plagued by rising inflation and disrupted stock market performance, many of FDM’s clients have found …

Read More

Should you Buy Down a Lower Mortgage Rate?

Mortgage Rates Hit a 40-Year High? Would a Buydown Help? Over the past two-years the rapid increase in mortgage rates shocked potential homebuyers. …

Read More

Apply for a mortgage online or in person

In today’s digital world, it’s easier than ever to apply for a mortgage online. A few clicks, some basic information, and—boom—you’ve started the proc …

Read More

Refinancing a Mortgage: A Comprehensive Guide

Refinancing a mortgage can be a powerful financial tool for homeowners looking to save money, pay off debt faster, or change the terms of their h …

Read More

Tax Benefits of Owning a Home

For many, buying a home is a major financial milestone — one that brings stability, pride, and long-term investment potential. But beyond building equ …

Read More

Right Time to Refinance Your Mortgage

When is the Right Time to Refinance Your Mortgage? Refinancing a mortgage can be a smart financial move, but timing is everything. Homeowners often wo …

Read More

Renovation Loan is a Smart Financial Move

Why a Renovation Loan is a Smart Financial Move? Whether you’re upgrading an outdated kitchen, adding a new bathroom, or repairing a leaky roof, home …

Read More

Spring is the Best Time to Buy a House

Why Spring is the Best Time to Buy a House? Spring is often associated with fresh starts, blooming flowers, and longer days—but for many homebuyers, i …

Read More

How to Avoid Trigger Leads When Applying for a Mortgage.

How to Avoid Trigger Leads When Applying for a Mortgage. When you are applying for a mortgage, you are likely focused on securing the best interest ra …

Read More

Five Key Factors That Determine Your Mortgage Rate.

Five Key Factors That Determine Your Mortgage Rate. When buying a home or refinancing an existing loan, your mortgage rate plays a key role in determi …

Read More

How to Pay Off Your Mortgage Early

How to Pay Off Your Mortgage Early: A Practical Guide to Financial Freedom Paying off your mortgage early is a powerful financial move that can save y …

Read More

Homeowner vs. Renter Net Worth

The Wealth Gap: Homeowner vs. Renter Net Worth One of the most striking financial differences in the U.S. today lies in the net worth of homeowners co …

Read More

Home Prices Are Cooling

Home Prices Are Cooling: What It Means for Buyers and Sellers After years of rapid appreciation, the housing market is showing signs of a shift. Home …

Read More

Checking Your Credit Score

What is a Credit Score? A credit score is a three-digit number that reflects your creditworthiness, or how likely you are to repay debt. It is calcula …

Read More

Mortgage Insurance (PMI)?

What Is Private Mortgage Insurance (PMI)? Private Mortgage Insurance, commonly known as PMI, is a type of insurance that protects mortgage lenders aga …

Read More

Solar Panels on your Home? Pros and Cons Explained

Should You Put Solar Panels on your Home? Pros and Cons Explained! With rising energy costs and growing concerns about climate change, many homeowners …

Read More

Understanding Secured Credit Cards Credit

Understanding Secured Credit Cards: A Smart Step Toward Building Credit Secured credit cards are powerful financial tools designed to help individuals …

Read More

Challenges of Self-Employed Buyers

The Challenges Self-Employed Buyers Face When Getting a Mortgage Buying a home is a major milestone, but for self-employed individuals, securing a mor …

Read More

Rule of 72

Understanding the Rule of 72: A Simple Tool for Estimating Investment Growth Albert Einstein said: “Compound interest is the eighth wonder of the …

Read More

Break Even on a Mortgage Refinance

How to Determine When You Break Even on a Mortgage Refinance Refinancing your mortgage can be a smart financial move, but it is important to know when …

Read More

Mortgage Rate Drop After a Fed Rate Cut

Why Mortgage Rate May Not Drop Much After a Fed Rate Cut. Market Reaction Precedes Fed Action The question of the day in the news is what will the Fed …

Read More

Benefits of a Pre-Approval

Before venturing into the property market to shop for a home, you need to get pre- approved. This process requires a careful scanning of your current …

Read MorePOSTS, Market Updates & Product News

FHA Streamline. The Easy Way To Refinance!

An FHA Streamline Refinance is designed to make it easier and faster for borrowers with an existing FHA-insured mortgage to refinance into a new FHA loan. The key appeal is the reduced paperwork and underwriting compared with a traditional refinance. …

Read More

The Thaw Begins:

Weekly housing data shows a gradual normalization after winter lulls, with new listings beginning to expand and buyer activity picking up as market data returns to typical seasonal patterns. Elevated inventory in many areas is giving buyers more option …

Read More

A 15-Year Mortgage.. The Espresso Shot of Mortgage Loans !

A 15-year mortgage is basically the espresso shot of home loans. While a 30-year mortgage slowly sips interest for three decades like it’s at brunch, the 15-year shows up, pays things off, and leaves early. The biggest perk is the massive interest savi …

Read More